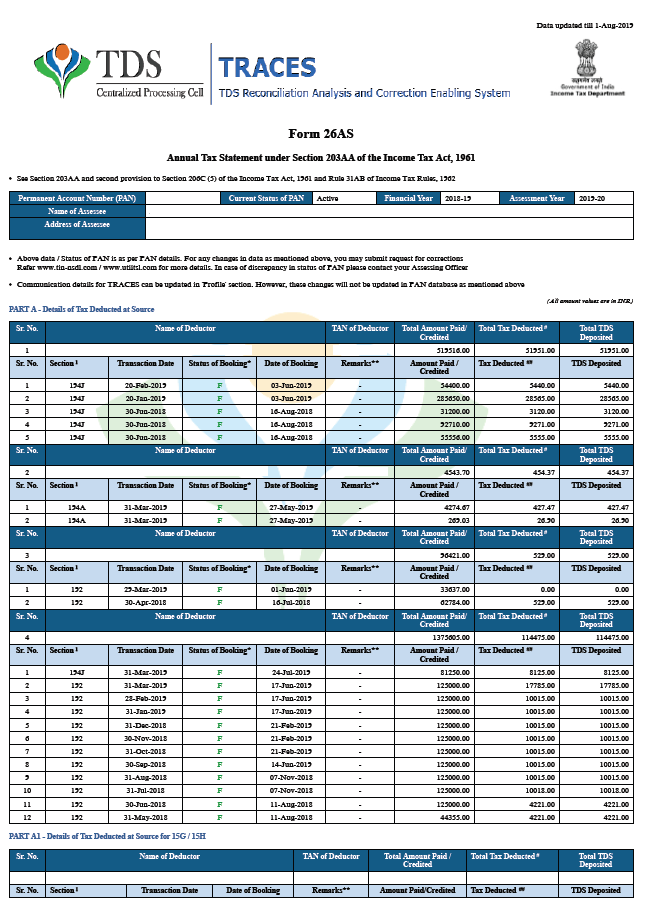

Click on MY ACCOUNT. Form 26AS is very essential as it is the passbook in relation to the income tax credit and debit. View form 26as without registration. Here are a few ways to do so. After getting registered log in to the user ID. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal. Click on View Tax Credit Form 26AS Select Assessment year. Login to your income tax portal account with your credentials. After logging in to your account you can view Form 26AS through a series of clicks. View Form 26AS without Registration The one and only way to view your Tax Credit Statement without enrolling on the Income Tax portal is through your Net Banking account.

Your PAN card should be linked to your online bank account to access Form 26AS. Then click on Form 26AS. Logon to e-Filing Portal wwwincometaxindiaefilinggovin. Here are a few ways to do so. Watch this video to know How to View Form 26AS and Download it from TRACES website. How to match form 16 and form 26as. Select Continue and click on View 26AS. To view or download form 26AS please Login with your credentials to your income tax portal account please click on tab e-File From drop down menu click on Income Tax Returns and select View Form 26AS Confirm and click on View 26AS. View Form 26AS without Registration The one and only way to view your Tax Credit Statement without enrolling on the Income Tax portal is through your Net Banking account. TDS and TCS amendments wef 1st July 2021.

To view or download form 26AS please Login with your credentials to your income tax portal account please click on tab e-File From drop down menu click on Income Tax Returns and select View Form 26AS Confirm and click on View 26AS. Download Form 26AS by logging in to your income tax filing account directly on The Income Tax Department e-filing website at httpsincometaxindiaefilinggovin. Your PAN card should be linked to your online bank account to access Form 26AS. Click on My Account tab. Login to your income tax portal account with your credentials. How to View and Download Form 26AS without Login User Id and Password or Registration on Income Tax - YouTube. Click on View Tax Credit Form 26AS Select Assessment year. How to see Form 26AS online without registration. A new page will open click on agree checkbox and PROCEED. Select Continue and click on View 26AS.

You can view your Form 26AS on and from Financial Year 2008-2009. Simply follow the steps given below. TDS and TCS amendments wef 1st July 2021. To proceed to view the tax credit form under My Account click the first option from the dropdown View Form 26AS Tax Credit. The Form 26AS can be downloaded from TRACES website. CA Final Advanced Auditing and Professional Ethics Question Paper New Course July 2021. To view or download form 26AS follow the steps below. Select Continue and click on View 26AS. Click on MY ACCOUNT. Read the disclaimer click Confirm and the user will be redirected to TDS-CPC Portal.

Select the assessment year for which you want to view Form 26AS from the dropdown. Deductor logs in to TRACES. Fill captcha and click on ViewDownload. TDS and TCS amendments wef 1st July 2021. Once you log in click on View Form 26AS Tax Credit. This video will help you understand the step-by-step process of downloadi. If playback doesnt. Form 26AS is linked to the Permanent Account Number. This feature is available for only those valid PANs for which TDS TCS statement has been previously filed by the deductor. Option 3 View Form 26AS through TRACES Website This facility is available to PANs that are registered with TRACES website for view of 26AS statement.