Operating income is the amount of revenue left after subtracting operating expenses and cost of goods sold COGS. These might include the cost of goods sold cost of production cost of sales cost of labour or inventory. The net operating income or NOI is a formula used to determine how profitable property is in a year. Operating income also called income from operations takes a companys gross income which is equivalent to total revenue minus COGS and subtracts all operating expenses. The FCF formula is Free Cash Flow Operating Cash Flow Capital Expenditures. Is Net Sales same as gross profit. A companys sales revenue also referred to as net sales is the income that it receives from the sale of goods or services. Operating Profit Revenues COGS Operating Expenses. Calculating this equation is fairly simple when one has the three following values. The net operating income formula is simple.

Is Net Sales same as gross profit. The operating income formula provides a simple calculation for evaluating common business models. Operating Profit Revenues COGS Operating Expenses. Operating income also called income from operations takes a companys gross income which is equivalent to total revenue minus COGS and subtracts all operating expenses. Income From Operations Net Income Interest Expense Taxes. Revenues cost of goods sold and operating expenses. Net Operating Income NOI Formula. Operating income is a measure of profitability that is directly related to a companys operations. Subtract the operating income of the previous year from the current years operating income. In 2017 free cash flow is calculated as 18343 million minus 11955 million which equals 6479 million.

Operating income is the amount of profit made from a companys business operations after accounting for operating expenses. This is the formula. Net Operating Income NOI Formula. Operating Profit Revenues COGS Operating Expenses. Operating income Total Revenue Direct Costs Indirect Costs. Essentially it is the amount of revenue left after all operating. Divide this number by last years operating income and multiply by 100. Is Net Sales same as gross profit. It is done by subtracting all operating expenses from the gross operating income. Operating Income Revenue Cost of Goods Sold Operating Expenses.

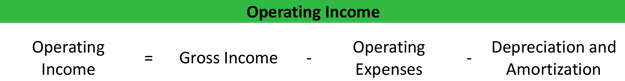

Operating income is the amount of profit made from a companys business operations after accounting for operating expenses. The net operating income or NOI is a formula used to determine how profitable property is in a year. Operating income Gross Profit Operating Expenses Depreciation Amortization. Operating income Net Earnings Interest Expense Taxes. R R real estate revenue O E operating expenses beginaligned textNet operating income RR - OE textbf. The concept of income from an operation is very important because it is a profitability measure that assesses the operating performance of a company before the impact of financing cost and taxes. Is Net Sales same as gross profit. There are three formulas to calculate income from operations. This is percent change in operating income. Operating income is the amount of revenue left after subtracting operating expenses and cost of goods sold COGS.

Operating income also called income from operations takes a companys gross income which is equivalent to total revenue minus COGS and subtracts all operating expenses. Is Net Sales same as gross profit. Income From Operations Net Income Interest Expense Taxes. Net Operating Income Gross operating income Total operating expenses Nuances of calculating total operating income on a commercial investment property. Divide this number by last years operating income and multiply by 100. A companys sales revenue also referred to as net sales is the income that it receives from the sale of goods or services. Essentially it is the amount of revenue left after all operating. Relevance and Uses of Income from Operations Formula. The net operating income formula is simple. The FCF formula is Free Cash Flow Operating Cash Flow Capital Expenditures.